The introduction of the Climate-Related Financial Disclosures Bill is a significant development that businesses across Australia need to prepare for. There has been a lot of conflicting information in the press, which can cause confusion, but lets look at how this new legislation aligns with the services Climatics offers and what it means for your business.

Understanding the Climate-Related Financial Disclosures Bill

Climatics is the leading historical climate database in Australia, helping to understand your asset and portfolio risk

The federal government’s mandatory Climate-Related Financial Disclosures (CRFD) legislation, introduced as the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024, aims to enhance transparency and accountability in how businesses assess and report on climate risks. Here are the five key takeaways from the bill and how they relate to Climatics’ capabilities:

-

Delayed Start for Group 1 Reporting:

Group 1 entities will now report for a financial year commencing on or from 1 January 2025, with potential delays depending on the bill's passage.

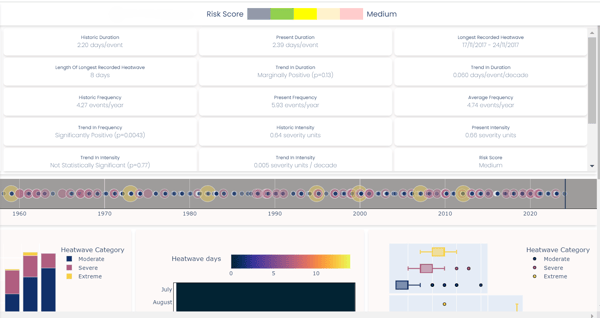

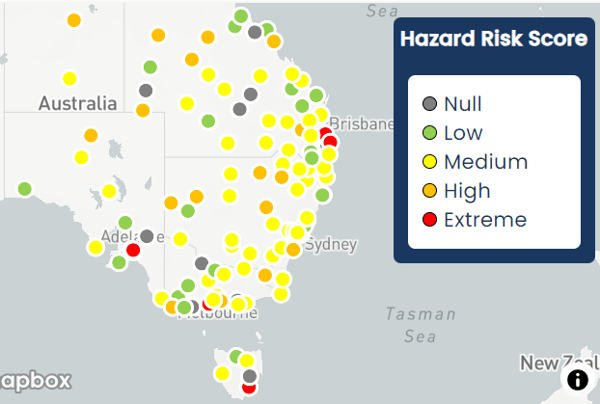

Climatics’ platform helps businesses to start preparing now by using historical weather and climate events data presented on a map and in trend graphs. This feature can help Group 1 entities begin assessing their climate risk exposure early, ensuring they’re ready when reporting commences.

-

Expanded Safe Harbour Provisions:

The bill expands safe harbour from private litigation to include scope 3 GHG emissions, scenario analysis, and transition plans, but not voluntary marketing materials.

By offering detailed scenario analysis and data visualisation, Climatics helps businesses create robust reports that fall under the 'protected statements,' maximising the benefit of safe harbour provisions.

-

No Safe Harbour from ASIC Enforcement:

All ASIC enforcement actions, including penalties for misleading conduct regarding 'protected statements', are outside the safe harbour.

Climatics provides accurate and reliable data that helps ensure all statements are backed by credible information, reducing the risk of enforcement actions due to inaccuracies.

-

Amended Directors’ Declaration:

Directors need to declare that the sustainability report is “in accordance with the Act” rather than complying with international standards initially.

Our platform helps ensure that your data and reports are aligned with the national standards, aiding directors in making accurate declarations.

-

Open Timeline for Assurance Consultation:

Auditing standards will evolve before 1 July 2030, defining the level of assurance required for sustainability reports.

As auditing standards develop, Climatics can adapt its offerings to meet evolving assurance requirements, helping businesses stay compliant over time.

Next Steps for Organisations

As the bill progresses through the parliamentary process, organisations, particularly those in Group 1, need to prepare for the upcoming changes. Climatics can help by:

- Allowing you to visualise how historical climate events affect your assets. This can serve as a preliminary risk assessment tool for climate risk reporting.

- Providing the necessary climate and weather data trends over time, essential for fulfilling the bill’s data requirements.

- Using Climatics to engage with the principles set out by the Taskforce on Climate-Related Financial Disclosures (TCFD) and prepare for the transition to mandatory reporting.

The Climate-Related Financial Disclosures Bill is more than a regulatory requirement; it's an opportunity to turn climate risk into a strategic advantage. Climatics is here to support your journey with our advanced platform, helping you not just comply with the new regulations but also enhance your business resilience against climate risks.

Contact our team to stay ahead of the curve with Climatics, and ensure your business is prepared for the future of climate risk reporting.